Williamson County and Tax Estimator Tool

Organization Profile

- Industry: County Government

- Location: Georgetown, Texas

- Number of Employees: 58

- Population: 525,000

- Number of years as a Tyler client: 13+

- Tyler Products Used: Assessment & Tax Pro and Enterprise Justice

Challenges

On an almost daily basis, constituents called the Williamson County Tax Assessor/ Collector’s Office for property tax estimates. To provide an accurate answer, one of the office’s call center employees had to look up the property, determine the tax entities involved and, in many cases, add in a homestead, disabled veteran or over-65 exemption. From beginning to end, the person fielding the call spent roughly ten minutes calculating the tax estimate for each property.

If callers representing commercial interests — such as banks, realtors and title companies — requested estimates for multiple properties, the call center employee took 30 minutes or more to provide the needed estimates. This resulted in other taxpayers being placed on hold for extended periods of time.

As both commercial and residential development expanded throughout this rapidly growing county, the call center began receiving a greater number of inquiries.

Tyler and their team delivered our vision and then some. The tax estimator has significantly increased our staff’s efficiency and level of customer service when responding to taxpayer questions.

Larry Gaddes

Tax Assessor/Collector Williamson County Tax Assessor/Collector’s Office

“We created a special spreadsheet to better organize the process, but it had little effect on the amount of time it took to calculate tax estimates,” said Larry Gaddes, Williamson County’s Tax Assessor/ Collector. “We were also concerned about the potential for data entry errors, which would result not only in miscalculations, but financial consequences for the taxpayer.”

Solution

As a long-time user of Tyler Technologies’ software, Gaddes knew that it provided the flexibility needed to solve the biggest challenges faced by appraisal and tax offices. He decided to put it to the test and reached out to Tyler to create a new online property tax estimation tool.

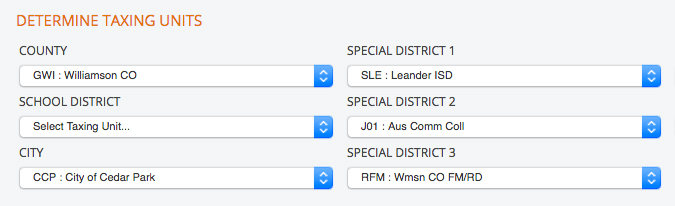

Initially, Gaddes wanted to enable taxpayers to enter much of their own data, while selecting information, such as the city, school district and other taxing entities, from dropdown lists. Based on his request, Tyler’s expert staff delivered a beta version of the online tax estimator. Both Gaddes and Tyler staff felt the tool should be simplified. The user had too many dropdown options to choose from, potentially leading to confusing results.

Tyler returned with an updated property tax estimator that had only one field that required data entry — the property address. The user would enter the address and the rest of the required data would be pulled directly from Assessment & Tax Pro, including the property value and multiple taxing entities that applied to the address.

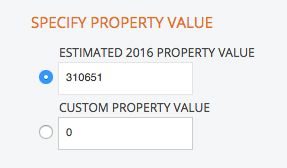

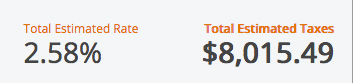

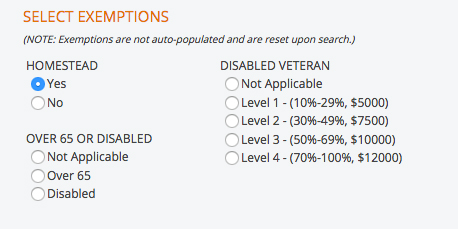

The property tax estimate would be instantly tabulated based on the data. Each user could adjust the property value, if desired, and then choose any applicable exemptions from a dropdown menu. The property tax estimate would change accordingly.

Maritza Aragon, the Williamson County call center’s information services manager, asked her staff to try the updated version of the tax estimator. They found that it was a very fast and efficient method for serving the needs of constituents. Maritza then submitted feedback to Tyler for consideration on additions and changes that could improve the user experience.

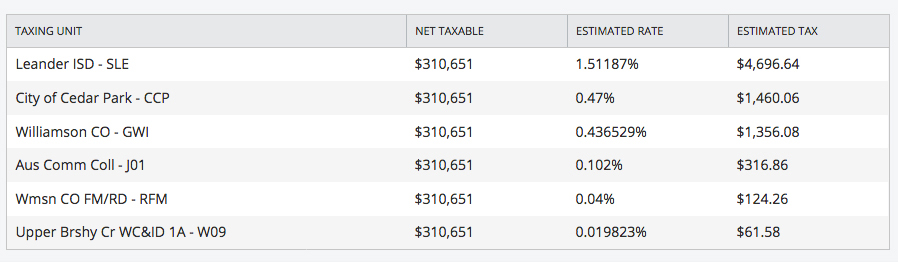

The user can review the applicable taxing entities that instantly populate when the property address is entered and see the breakdown of estimated tax rates and amounts per entity.

Results

After a period of fine tuning, Tyler provided access to the tax estimator on the county tax assessor/ collector’s website. The call center staff began referring realtors, banks and title companies to the new tool. Many of these constituents have come to rely on it, including a title company employee who recently used it to calculate tax estimates for 500 properties.

Call center staff also installed shortcuts to the online tool on their desktops so they could quickly calculate estimates for other taxpayers.

“I love the flexibility of the Tyler software and how it easily generates values in the tax estimator,” Aragon said. “The estimator is simple to use and requires very little training. It’s so easy to change values and choose exemptions.”

Overall, the Williamson County Assessor/ Collector’s Office receives fewer calls requesting property tax estimates. The call center staff also spends far less time calculating tax estimates than they used to.

As a result of introducing the new online tax estimator, the office saved approximately $3,000 in work hours over a span of five months. The county projects an estimated annual savings of $7,000 using the new tool. Gaddes and his staff are certain that the savings will only continue to grow with the ever-expanding population of Williamson County.

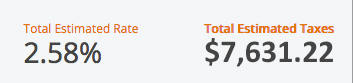

Once the property address is entered, the user can view estimates of the property value, tax rate and tax payment. The user can also adjust the property value in the “Custom Property Value” field.

If users need to include an exemption, they can choose one or more from the on-screen list.

After choosing an exemption from the list, users click the recalculate button and the new, adjusted property tax estimate appears.

Learn How Tyler Solves Your Office’s Biggest Challenges

By using Tyler’s Assessment & Tax Pro property assessment and tax administration software, the Williamson County Assessor/ Collector’s Office could build and power an online tool that transformed the efficiency of their call center team and saved them thousands of dollars a year.

You can depend on Assessment & Tax Pro to help you tackle your office’s biggest challenges. This highlyflexible software solution delivers unparalleled access to appraisal, tax and collection information across hundreds of jurisdictions. Whether your office is big, small or somewhere in between, you can handle all your essential appraisal and tax functions with Tyler’s intuitive, easy to access, tightly integrated property management and tax billing and collection solution. Tyler’s expert staff can also help you use the flexibility of Assessment & Tax Pro to apply unique tools that streamline processes, such as the online tax estimator, or assist you in developing your own.

I love the flexibility of the Assessment & Tax Pro software and how it easily generates values in the tax estimator.

Maritza Aragon

Information Services Manager, Williamson County Call Center